Leonardo Camacho, a committed capitalist, has little time for the socialist ideals espoused by President Hugo Chávez of Venezuela. But even for him, the “Bolivarian revolution” has some redeeming features.

“They’re just giving money away,” he says incredulously, puzzling over why Venezuela’s foreign exchange administration agency, Cadivi, should approve his request for dollars for what he described as a “state-subsidised” holiday to Panama. “I’d be crazy not to do it,” he adds.

He is one of a rapidly growing sector of middle-class Venezuelans taking advantage of one of the economy’s biggest and most bizarre distortions. Since foreign exchange controls were introduced in 2003, Venezuela’s currency has been fixed at 2,150 bolívars (or 2.15 “strong” bolívars since three zeroes were knocked off the currency on January 1) to the dollar.

Economists estimate the current “true” rate to be closer to five “strong” bolívars, and on the black market the dollar has reached almost seven bolívars.

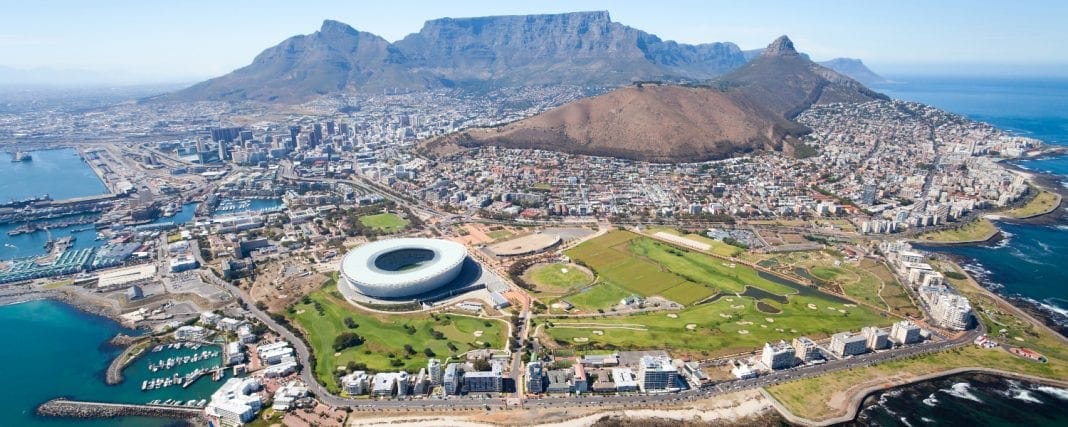

More and more Venezuelans are now taking holidays to cash in on a $5,000 annual quota that can be spent on credit cards at the official exchange rate abroad.

Unsurprisingly, many are abusing the system. Anecdotes abound of Venezuelans travelling to nearby Caribbean islands for just one night to convert their quota into hard currency, which can then be sold on the black market in Venezuela for a handsome profit.

One favoured method has been to buy poker chips, cashing them in after a token flutter. Others make fake purchases at shops whose owners will provide cash and a receipt in return for a commission.

Some with enough contacts are making a living through arbitrage. People with credit cards who cannot afford to use their dollars from Cadivi sell their quotas to those who can. According to Cadivi, from January to November last year, Venezuelans spent more than $4bn (€2.7bn, £2bn) on credit cards abroad, compared with just over $1bn the year before. By contrast, Cadivi approved only $2.2bn for food importers, even though the nation is battling food shortages.

International air travel leapt more than 40 per cent during 2007.

The government has begun to react. Until now, Venezuelans were also able to spend a $3,000 quota for credit card purchases abroad over the internet. That allowance has been cut to $400. A law came into force yesterday establishing penalties for violating exchange controls, banning the publication of any exchange rate other than the official one and forcing retailers to declare whether they are selling goods obtained with Cadivi dollars.

The government has put its faith in the change. “We are absolutely sure that this new law will correct the problem,” says Simon Esca-lona, vice-president of the National Assembly’s finance commission. “You can be quite certain that this year the value of the so-called speculative dollar will fall.”

Orlando Ochoa, an economist, says the government faces a dilemma: continued restricted access to dollars will raise inflation, already the region’s highest, while trying to satisfy demand will cause central bank reserves to fall, eventually triggering a foreign exchange crisis.

“The government knows what the problem is but it doesn’t know how to solve it – so they’ve introduced this law to try to hide the problem instead,” he says.

ft.com

WHAT TO TAKE AWAY FROM THIS ARTICLE:

- More and more Venezuelans are now taking holidays to cash in on a $5,000 annual quota that can be spent on credit cards at the official exchange rate abroad.

- Anecdotes abound of Venezuelans travelling to nearby Caribbean islands for just one night to convert their quota into hard currency, which can then be sold on the black market in Venezuela for a handsome profit.

- A law came into force yesterday establishing penalties for violating exchange controls, banning the publication of any exchange rate other than the official one and forcing retailers to declare whether they are selling goods obtained with Cadivi dollars.