Hotels around the world have reported rate growth of 4% in the first half of 2011, according to the latest hotel survey from Hogg Robinson Group (HRG), the international corporate services company. Of the 50 cities surveyed, 33 reported a year on year increase in hotel rates with strong growth in Asia and an unexpected boost from cities such as Istanbul. Growth would have been higher had cities in Africa and Eastern Europe not reported year on year decreases over the last six months.

Stewart Harvey, Group Commercial Director at HRG, says:

“Yet again our survey indicates how important it is for clients to keep control of their hotel programmes and drive volumes to maximise returns. Despite the fact that many large companies have put in place travel restrictions and cost reductions, hotel rates in the majority of cities surveyed increased. Demand is driving the rate.”

“We can expect hotel rates to continue to rise as more economies grow and business demand picks up. During this time it is critical for clients looking to minimise travel spend to work with us to negotiate fair hotel rates.”

Margaret Bowler, Director Global Hotel Relations at HRG, says:

“The shift from Europe to Asia in hotel rate growth is significant in that it demonstrates changing business priorities. The rates demonstrate that demand has increased for travel to emerging regions as a result of the need to do business and that travellers are willing to pay higher hotel costs during their stay. Outside of Asia, Istanbul in particular has come out with strong rate growth.”

Trends noted by HRG include:

§ Over two-thirds of the cities surveyed reported hotel rate growth, compared with only one-quarter of cities last year, supporting signs of global recovery and pick up in business travel in recent months.

§ Moscow retained its top position with the most expensive hotel rates, despite a modest rate increase in local currency and GBP. It bounced back from last year’s 12% decrease despite many new hotel openings, demonstrating the city’s position as a strong business destination.

§ Istanbul achieved the highest increase in hotel rate of 37% due to the growing interest surrounding the city as a business destination. Travellers to Istanbul are also conscious of its security issues and more inclined to stay in five-star accommodation.

§ The strongest performing region was Asia Pacific, where average room rates rose by 7% due to the concentration of hotel development and financial centres including Hong Kong and Singapore.

§ Hotel rates in Eastern Europe had the highest regional rate decrease of 6.6%. These average rates may have been lower still, were it not for strong performances in both Bucharest and Kiev where rates rose by 4%.

§ UK cities reported weak hotel rates when compared to the previous year, in spite of a boost from the January VAT increase. Hotels in the Heathrow area reported strong growth but many other cities such as Liverpool showed a decrease in rates.

§ North American destinations finished the first half of the year with an overall 4% rate increase in local currency. All destinations reported growth in local currency with the exception of Los Angeles, Toronto and Montreal which were flat.

Top 50 cities globally average room rate by GBP:

January – June 2011 City

January – June 2011 Average Room Rate

January – June 2010 Average Room Rate Variance

MOSCOW £260.68 £257.80 1%

GENEVA £227.64 £201.19 13%

ZURICH £220.40 £188.53 17%

PARIS £208.21 £197.49 5%

STOCKHOLM £201.77 £183.45 10%

WASHINGTON £198.75 £193.49 3%

SYDNEY £197.29 £169.54 16%

ISTANBUL £196.05 £157.61 24%

NEW YORK CITY £193.96 £194.12 0%

OSLO £193.70 £175.26 11%

HONG KONG £189.84 £196.24 -3%

AMSTERDAM £172.63 £169.15 2%

MILAN £170.28 £178.37 -5%

FRANKFURT £168.88 £160.78 5%

MUMBAI £167.65 £160.79 4%

COPENHAGEN £166.55 £163.55 2%

ROME £165.82 £168.30 -1%

SAN FRANSISCO £162.55 £144.04 13%

TOKYO £162.50 £169.05 -4%

BASEL £162.04 £140.87 15%

BRUSSELS £161.04 £149.64 8%

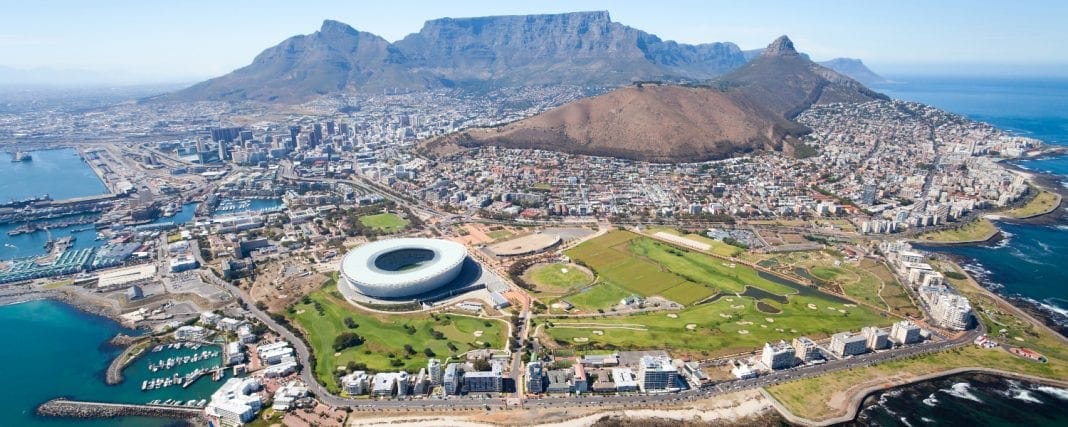

JOHANNESBURG £160.05 £157.04 2%

SINGAPORE £159.76 £145.04 10%

ABU DHABI £158.07 £185.62 -15%

LONDON £156.82 £153.85 2%

BANGALORE £153.40 £125.63 22%

BARCELONA £152.15 £137.72 10%

DUBAI £148.44 £158.86 -7%

Margaret Bowler, Director Global Hotel Relations at HRG, says:

“The hotel survey for January to July 2011 shows a mixed set of results. In Asia Pacific hotel rates soared as a result of the region’s growing economic dominance and the proliferation of financial centres across the region including Hong Kong and Singapore. This contrasted strongly with the Middle East where hotel supply outstripped demand meaning rates fell sharply.

Key international cities like London, New York and Paris reported hotel rate increases, demonstrating buoyancy and resilience. London, in particular, is expected to flourish next year as it hosts the Olympics next summer. However, many UK provinces did not perform as well as expected.

“Overall, our research shows that global hotel rates are increasing and have been exhibiting signs of growth. Looking ahead, we anticipate that hotel rates will continue to rise if the economy improves.”

WHAT TO TAKE AWAY FROM THIS ARTICLE:

- Of the 50 cities surveyed, 33 reported a year on year increase in hotel rates with strong growth in Asia and an unexpected boost from cities such as Istanbul.

- The rates demonstrate that demand has increased for travel to emerging regions as a result of the need to do business and that travellers are willing to pay higher hotel costs during their stay.

- § Istanbul achieved the highest increase in hotel rate of 37% due to the growing interest surrounding the city as a business destination.